The stats for the US market in 2019 are in – and, in usual circumstances, the simple headline would be this: consumers in the United States pressed play on music streaming services (across video and audio) more than a trillion times last year.

This data point, from trusted Stateside market monitor BuzzAngle’s yearly report, reflects a 24.8% (+200.5bn) year-on-year rise in total on-demand music streaming volume in the US.

On-demand audio streams were up by 32.0%, or 171.3bn, to 705.9bn in 2019, says BuzzAngle. That was actually a bigger year-on-year climb – in real terms – than the US industry saw in 2018, when audio streams grew by 157.7bn to 534.6bn.

The big, rosy, news for labels, then: audio streaming growth is still accelerating (in volume terms) in the United States, the world’s biggest music market.

The less big, less rosy news: physical album sales (including CD and vinyl) tanked by 20.9% in the US last year, says BuzzAngle, sinking to 55.7m.

And total album sales (across download and physical – not including ‘streaming equivalents’) sunk by 23.2% to 93.0m.

That 93.0m figure has been hammered down by more than a third on the equivalent number from 2017, when 141.8m albums were sold in the States. (All of these stats come from the annual reports of BuzzAngle.)

Nothing too unexpected, then – with audio streams, if anything, performing better than some might have forecast in the United States last year.

So what’s with the potential “superstar recession” in MBW’s headline above?

Allow us to intrigue you, with arguably the most telling US industry statistic of the year.

According to BuzzAngle, Post Malone (pictured) was the biggest recorded music superstar of 2019 in the States. Having released his blockbuster Hollywood’s Bleeding album in September, he racked up some 5.47bn on-demand audio streams across the calendar 12 months.

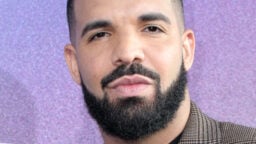

Yet in 2018, the prior year, the biggest audio streaming superstar in the United States was Drake, who, says BuzzAngle, collected a massive 7.74bn on-demand audio streams in the period.

So, despite a 32.0% YoY rise in overall audio streaming activity, the biggest streaming star in the States actually attracted fewer plays than the equivalent artist in the prior year.

Not only that: in 2017, the biggest audio streaming artist in the United States, according to BuzzAngle numbers – Drake, again – clocked up 5.53bn audio on-demand streams in the year.

You spotted it? Even that 5.53bn stat was bigger than the 5.47bn play-count that 2019’s king of U.S audio streams, Post Malone, put on the scoreboard.

So what’s going on?

Clue: this ain’t just about Drake and Post Malone. It’s more systemic than that.

Let’s look at the cumulative streams of the Top 5 audio streaming artists in the United States over the past three years – all based on BuzzAngle numbers, taken from the platform’s annual Top 25 chart.

(If you’re wondering why we’re discounting video streams from these calculations, it’s because, according to BuzzAngle’s 2019 report, certain video platforms – ahem, YouTube, ahem – changed their reporting methodology last year, which appears to have resulted in suspiciously low comparisons versus the prior 12 months.)

Here’s 2019’s Top 5:

- Post Malone (5.47bn streams);

- Drake (5.33bn);

- Billie Eilish (3.81bn);

- Ariana Grande (3.72bn);

- Youngboy Never Broke Again (3.49bn).

Total audio streams there: 21.82bn.

Now look at the Top 5 audio streaming artists from 2018:

- Drake (7.74bn);

- Post Malone (4.93bn);

- XXXTentacion (4.27bn);

- Travis Scott (2.76bn)

- Eminem (2.58bn);

Total audio streams there: 22.28bn.

Yep: the total audio streams of the United States’ biggest five artists on the likes of Spotify and Apple Music actually attracted a smaller cumulative play-count in 2019 than they did in the prior year.

Looking at the numbers, the huge popularity of Drake (and his Scorpion album) in 2018 is obviously the most influential factor at play.

So let’s widen our lens, and look at the cumulative annual play counts of the Top 5, Top 10 and Top 15 audio streaming artists over the past three years:

“Superstar recession? What superstar recession? The Top 10 and Top 15 artist play-counts clearly went up a bit last year, dummy. All this suggests is that 2019 was a bit flat on releases from massive megastars like Drake, right?”

Keine chance, as our 100bn-streaming friends in Germany might say.

Here’s where scheisse gets real.

By correlating the above numbers with BuzzAngle’s figures for the total US on-demand audio streaming market volume in each given year, we can get a picture of the overall market share of the Top 5, Top 10 and Top 15 streaming artists in each period.

Check it out:

Decline. Decline. Decline.

Look at the Top 15 artists: they’ve collectively lost over 2% (!) market share in the past two years alone.

Why does this matter? You already know why:

- (i) Because of the way streaming services pay record companies and artists;

- (ii) Because of what it tells us about where the growth of streaming is coming from.

In the first nine months of 2019, to end of September, Spotify’s ‘Cost Of Revenues’ – mainly made up of its royalty payments to music rightsholders – came out at €3.66bn, or $4.13bn.

If the Top 10 biggest superstars on the planet (and their labels) received a cut of this money in line with their US audio streaming market share (5.09%), they would have been paid $210m between them.

What if their equivalent 2018 market share (6.66%) was applied to Spotify’s Cost Of Revenues in the equivalent nine month period of that year (€2.81bn/$3.37bn)?

Wait for it… they would have got $224m. A $14m year-on-year drop.

Yep: the Top 10 superstars in the world, according to our extrapolation of these U.S stats, may have generated less money from audio streaming services in 2019 than they did the year before.

Meanwhile, in the same time period, Spotify’s ‘cost of revenues’ leapt up by $760m.

Who obtained that extra money?

Clue: Very much not the year’s biggest Top 10 artists.

There can only be one conclusion: pretty much the entire growth of the United States streaming market in 2019 came from outside the ten biggest (Spotify/Apple Music etc.) artists of the year – 99% of it, to be more precise.

Whether this is good news or bad news for major record companies is a fair debate.

At the end of the day, the bulk of the industry’s streaming growth is being generated amongst a mass of ‘second-tier’ artists beyond the Top 10 acts – but it’s also not unlikely that Universal, Sony or Warner has a business relationship, in some capacity, with many of these acts.

For whom do the above stats definitely spell bad news?

Those who still believe in the concept of the all-conquering mainstream megastar – and those artists who dare to dream that, one day, it could be them.

FOOTNOTE: Those of a statty mindset can access the data that informed the above charts and analysis on MBW’s public Google Sheets doc here.

You can downloads the BuzzAngle 2019 report here; the BuzzAngle 2018 report here; and the BuzzAngle 2017 report here.

Please note that the Top 5, Top 10 and Top 15 audio streaming artists in the analysis above are based on audio streaming data only (excluding video) within BuzzAngle’s Top 25 streaming artists in each year. This is important as some artists in the Top 10 of the overall streaming list are not in the Top 10 of audio streaming-only rankings in each period.Music Business Worldwide