Live Nation reported another record third quarter, driven by surging global stadium activity and robust fan spending across all segments.

The concert giant’s revenue climbed 11% YoY in Q3 2025 to $8.5 billion from $7.65 billion in Q3 2024, according to its latest quarterly report published Tuesday (November 4).

Operating income jumped 24% YoY to $792.5 million, while adjusted operating income (AOI) rose 14% to $1.03 billion in the three months ended September 30.

Revenue growth was powered by an 11% YoY increase in the concerts segment to $7.28 billion from $6.58 billion, alongside a 15% YoY rise in ticketing revenue to $797.6 million. Revenue from sponsorships and advertising likewise grew 13% YoY to $442.7 million.

Michael Rapino, President and CEO of Live Nation, said: “Strong fan demand drove another record quarter, as we continue to attract more fans to more shows globally. With these tailwinds, 2026 is off to a strong start with a double-digit increase in our large venue show pipeline and increased sell-through levels for these shows.”

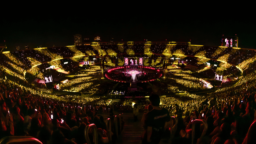

The company hosted over 51 million fans globally in Q3, with stadium shows up 60% from the prior year. Live Nation attributed the fan growth to double-digit increases across all major markets for stadiums, led by growth in Europe and Mexico.

“2026 is off to a strong start with a double-digit increase in our large venue show pipeline and increased sell-through levels for these shows.”

Michael Rapino, Live Nation

In Q3, Ticketmaster processed 89 million fee-bearing tickets, up 4% from last year, while fee-bearing gross transaction value (GTV) jumped 12% YoY driven by continued demand and market pricing for premium seats. Ticketmaster’s AOI surged 21% YoY to $286 million.

Live Nation Chief Financial Officer Joe Berchtold told analysts during an earnings call on Tuesday that the company saw 250 fewer amphitheater shows this year but expects strength across stadiums, arenas and amphitheaters in 2026.

Berchtold said: “We look like amphitheaters, arenas, and stadiums are going to have a very strong year next year, and on both international and American basis.”

For the full year 2025, Live Nation expects to attract approximately 160 million fans, marking the first time international attendance will surpass US attendance. Ticket sales for 2025 Live Nation concerts reached 150 million through October, up 4% from the same period last year.

The company’s deferred revenue (or the revenue it receives in advance) hit record levels in Q3, with event-related deferred revenue climbing 37% YoY to $3.5 billion and Ticketmaster deferred revenue rising 30% YoY to $231 million, reflecting strong advance demand for 2025 and 2026 shows.

Early indicators for 2026 point to continued momentum. The company has already sold 26 million tickets for next year’s shows, up double digits overall and across stadiums, arenas, and festivals. The large venue show pipeline for 2026 is likewise up double digits.

Rapino said: “We’re continuing to invest in new venues to grow the market, create jobs, and give artists even more ways to reach fans, positioning Live Nation on a clear path for double-digit operating income and AOI growth this year and compounding at this growth level over the next several years.”

Live Nation’s Q3 results also show that fan spending onsite remains robust, with amphitheater spending up 8% year-to-date and major festival spending up 6%. Venue Nation’s investments in hospitality continued to deliver strong returns, with newly refurbished venues showing significant per-fan spending growth.

Live Nation’s sponsorship segment posted a 14% YoY increase in AOI to $313 million, fueled by new partnerships with brands including Hollister, Kraft Heinz, Patrón and Trip.com, as well as an expanded Mastercard agreement across additional markets.

“The fact that [the fTC] would file this suit when we do more to stop bots and to counter a lot of this activity than the rest of the industry combined, we find to be very far afield.”

Joe Berchtold, Live Nation

The company recently refinanced $1.9 billion of debt and increased liquidity by $1.5 billion, reducing its weighted average cost of debt to 4.2%, down 30 basis points. Annual interest expense is expected to be approximately $350 million per annum.

When asked about the Federal Trade Commission‘s recent lawsuit related to scalpers, Berchtold said: “we feel very good about our case with the FTC.”

“The fact that they would file this suit when we do more to stop bots and to counter a lot of this activity than the rest of the industry combined, we find to be very far afield. And from a legal standpoint, we don’t believe that they have a strong case.”

Looking ahead, Live Nation expects to grow operating cash flow and free cash flow-adjusted by double digits for the full year, with capital expenditures on track to reach approximately $1 billion, of which $750 million is focused on venue expansion and enhancement projects.

Music Business Worldwide